Spotlight on UK’s FPS

The UK Faster Payments Service (FPS) was among the earliest IPS to launch, serving as inspiration for these systems globally. Banks have access to FPS directly or indirectly. Other payment service providers may also access FPS, depending on type of connection.

Over the last few years, the UK has seen an increase in authorized push payment fraud that is negatively affecting end user trust in the system. In response, the regulators and scheme rules authorities are responding by advocating for greater clarity in financial liability allocation, more specific DFSP risk management requirements, and shared tools, including improved fraud reporting mechanisms.

What’s Notable Related to Fraud Mitigation?

The Payments Systems Regulator and pay.uk are collaborating to develop rules that will make FPS participants liable for refunding end users who sent funds as a result of APP fraud.

Allocating financial liability for confirmed fraudulent events to DFSPs will reinforce importance of strong risk management by DFSPs.

The scheme rules already emphasize that DFSPs have primary responsibility for fraud mitigation and undertake suitable fraud checks in line with their own policies and refer DFSPs to follow prevailing legislative requirements regarding AML and the KYC process.

Specific requirements provide important guidance for DFSPs on effective risk management.

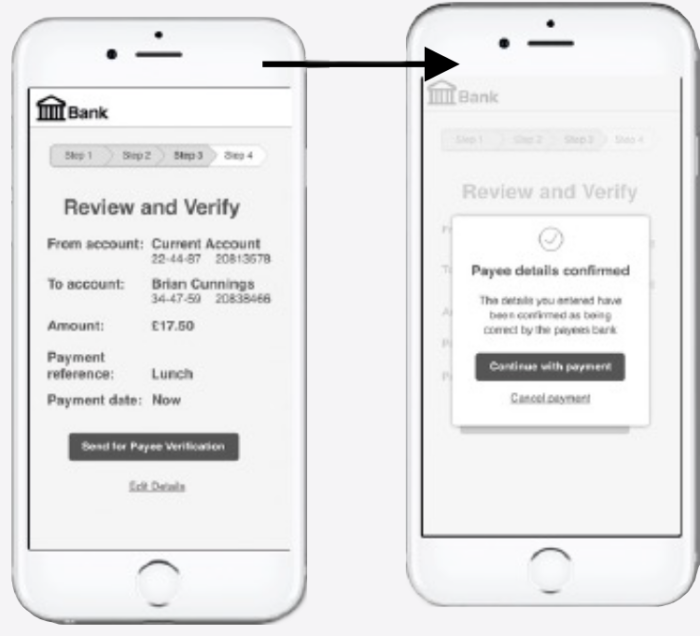

The confirmation of payee functionality provided to DFSPs enables a sender to validate if the name on the receiver account matches the name and account details of the person or business they intend to send money to before initiating the transfer.

Confirmation of payee is one tool that may enable end users in preventing fraudulent payments.

Finally, in its fraud strategy the UK government has committed to a comprehensive set of actions that includes development of additional fraud mitigation tools, improved fraud reporting mechanisms for end users, an appointment of an Anti-Fraud Champion to ensure collaboration of fraud initiatives across public and private sectors, and commitment to publish new regular data on patterns of fraud.

These efforts are intended to contribute to further mitigate fraud and build end user trust in the payments system.

Next Topic in this Section: Best Practices Overview