Southern African Development Community (SADC)

Working towards regional payments integration and low cost, cross-border, retail payments

What is SADC?

The Southern African Development Community is a sixteen country regional cooperative. The SADC Treaty is the basis for a range of efforts to bring about sustainable, collaborative development in important areas, including financial services, with the ultimate goal of poverty eradication.

SADC’s Role in Payments?

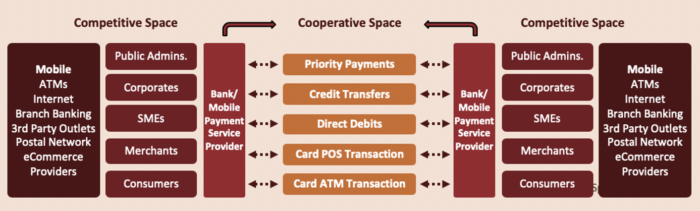

The SADC treaty provides the opportunity to inform the development of financial market infrastructure to support inter and intra-regional trade. Current interventions focused only in the cooperative (non-competitive) space and are working across multiple payments streams, including:

- Priority Payments

- Credit Transfers

- Direct Debits

- Card POS Transactions

- Card ATM Transactions.

This very ambitious scope provides challenges recognizing the vast differences in payments systems among participating countries, punctuated by a top-down mandate that requires implementation support by the private sector. However, the SADC community has had robust stakeholder engagement over the last 10 years, first to enable wholesale cross-border transfers and, more recently, to enable low-value, credit push, cross-border transfers. This low-value cross-border payments scheme is now branded as the ‘Transfers Cleared on an Immediate Basis’ (TCIB) scheme.

Scaling the TCIB Scheme

The SADC TCIB scheme aims to leverage global best practices to drive high volume, low cost transactions, including: -Banks and non-bank participation -Interoperability -International standards -Supporting multiple use cases.

First efforts are focused on onboarding banks and non-banks across participating countries using these best practices to drive scale. After the TCIB scheme proves it’s success regionally, there is an opportunity for countries in SADC to leverage the TCIB scheme for domestic as well as cross border transactions. This could be particularly appealing to countries that may have smaller populations and fewer domestic payment transfers.

TCIB Scheme Approach to Governance

The TCIB scheme development is currently led by the SADC Banking Association (BA). While the SADC BA has a robust governance structure, it is bank-centric, as the name implies. As a result, recognizing the TCIB scheme has both banks and non-banks as direct participants, the TCIB scheme is creating the TCIB Participant Association (TPA). The TPA will be an organization that can represent all stakeholders in the scheme. It will engage with regulatory structures when necessary, serve as a super user group guiding the direction of the scheme beyond go-live, and ensure the success of the TCIB scheme.

The Potential Impact

The success of the SADC effort provides the opportunity to support low-value remittances currently transferred through informal channels or through formal channels at very high costs. Moreover, the TCIB scheme serves as a model for other regions working to enable cross-border payment schemes.

What to Watch?

The TCIB scheme is set up for success. Moving forward, it will be worth paying attention to:

- How should the region work to harmonize regulation across the participating countries?

- How should SADC manage the variation in technical capabilities of participants?

- How will the SIRESS settlement system evolve to include multiple currencies? –

“Regional approaches to real-time retail payments, like what is taking place in SADC, promote scale and present an opportunity to drive costs down through shared utility infrastructure.”

Next Topic in this Section: China