Payment Scheme Governance

In order to realize the goals of the Level One Project, governance should be a deliberate consideration when creating or transforming a payments scheme

What is Payment Scheme Governance?

A Payment Scheme is an entity focused on the governance and functions of a payment system and its services. All the major decisions, such as the business model, what services to offer, features and functionality of services, pricing among participants, and which type(s) of digital financial service providers to include – are typically made by the payment scheme.

Governance is the collective management approaches, decisions, and oversight functions within the payment scheme. Governance determines or sets the tone for everything that occurs in the scheme with the scheme Rules being the principal manifestation

Some schemes are also the payment Operator while other schemes choose to outsource the operational activity to a third party. Most schemes select the provider that performs the scheme operations or provide guidelines for participants to connect to each other

What are Payment Scheme Rules?

The scheme rulebook contains all the parameters, standards and controls for the functioning of the payment scheme. Rules can be powerful instruments as they have the ability to include and exclude activities as well as participants

The core purpose of the Rulebook is to document rules that ensure operational efficiency and a clear understanding of rights and obligations (smooth functioning)

Rules can exclude some participants, disadvantage some participants, or create road blocks that impede how system participants can offer their services.

Rules can also create a “level playing field” for participants, drive scale (“accept all participant payment instruments” or mandate interoperability), enable multiple use cases and create additional economic efficiencies

Payments Scheme Governance: Best Practices

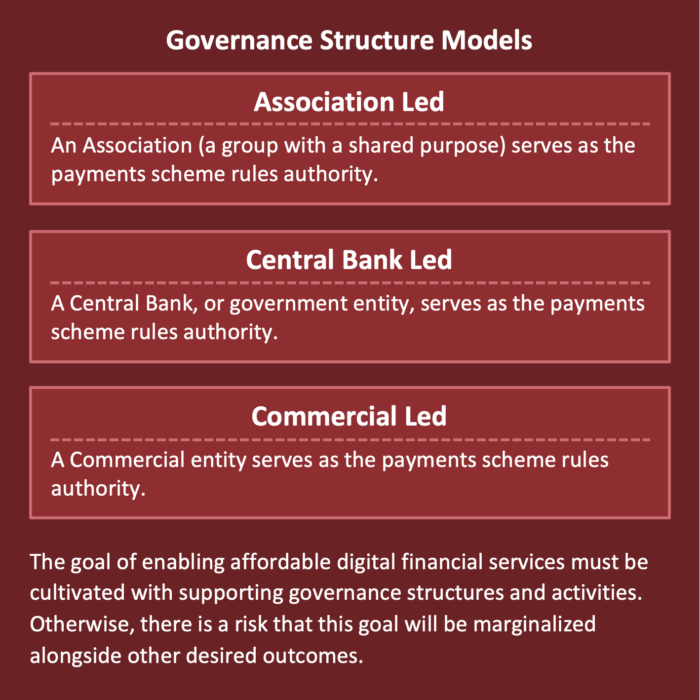

The Level One Project team recognizes three critical principles of governance that should be maintained, regardless of governance structure type. While an association-led model is most likely to support the critical principles of governance, the most suitable governance structure may vary, given the country/ regional circumstances and priorities. Entities must evaluate how best to foster all principles that promote financial inclusion (governance and non-governance).

Equal Ownership Opportunities: All direct participants of the scheme (banks and non-banks) are provided equal ownership opportunities in scheme governance as well as in scheme payment operations.

Participant Engagement: Direct and indirect participants are provided formal and informal mechanisms to provide input on the direction of the scheme, including the scheme rules.

Ensuring a Pro-Poor Posture: The scheme operates on a not-for-loss basis and the entity managing the scheme maintains a pro-poor posture, keeps costs as low as possible, where payments are considered a shared utility not a profit maximizing activity.

Next Topic in this Section: Enabling Multinational Payments Systems