IIPSs Provide Tools

Context

Fraud mitigation requires multiple tools

The Level One Project supports an open, competitive IIPS ecosystem where a variety of licensed financial institutions can serve as DFSPs. These DFSPs likely vary in their business models, operational capacity, and fraud risk management resources.

Moreover, managing fraud in a 24x7x365 environment is challenging and operationally demanding. It may also be costly and require new resources.

To comply with regulations and adhere to scheme rules, DFSPs rely on a myriad of fraud mitigation tools.

Fraud mitigation should not be a competitive advantage

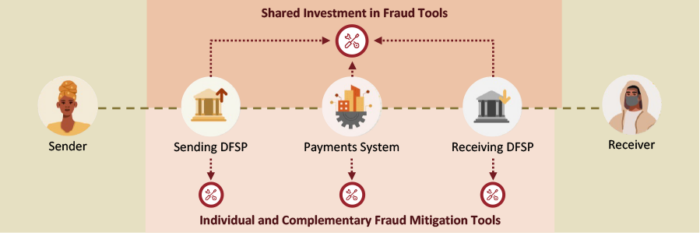

A shared investment in fraud mitigation tools can be particularly helpful in preventing fraud occurrences across the ecosystem. Investment in tools by the IIPS can help reduce the cost of fraud risk mitigation for individual DFSPs and the ecosystem.

Role of the IIPS

IIPSs should enable DFSPs in achieving a higher standard of fraud mitigation by providing fraud mitigation tools for DFSP use and implementing tools at the IIPS platform level

Real-time transaction screening or monitoring systems that are designed to detect unusual payment patterns and to stop suspicious transactions from being processed are a particularly valuable component of fraud risk mitigation.

The tools implemented by the IIPS itself can complement DFSP efforts. For example, the IIPS can also screen transactions for bad actors, incorporating information they capture across different participants. The IIPS can also develop and provide other valuable fraud mitigation solutions, such as a catalog of fraud typologies, confirmation of payee, and a safe payment-addressing approach.

An arrangement where all parties operate solutions that are complementary is most effective as fraudsters understandably work across DFSPs. These solutions vary in scope and may be implemented by the IIPS and/or by the individual DFSP.

IIPSs should also provide tools to DFSPs to help simplify the complaint process for end users and support the resolution process for DFSPs. These may range from one click fraud reporting, shared fraud notifications between DFSPs, white-labeled wallet with anti-fraud notifications, AI-enabled chatbots, fraud investigation coordination tools and services, and others.

Next Topic in this Section: Data as Enabler of Risk Mitigation