India

Introduction

The India technology stack facilitates digitizing transactions through a set of centralized services, including:

- Aadhaar Authentication layer

- A paperless storage layer, including eKYC and Digilocker

- A suite of digital payment services, including the Unified Payments Interface (UPI), that enable interoperability which also includes payments addressing

The Value of UPI

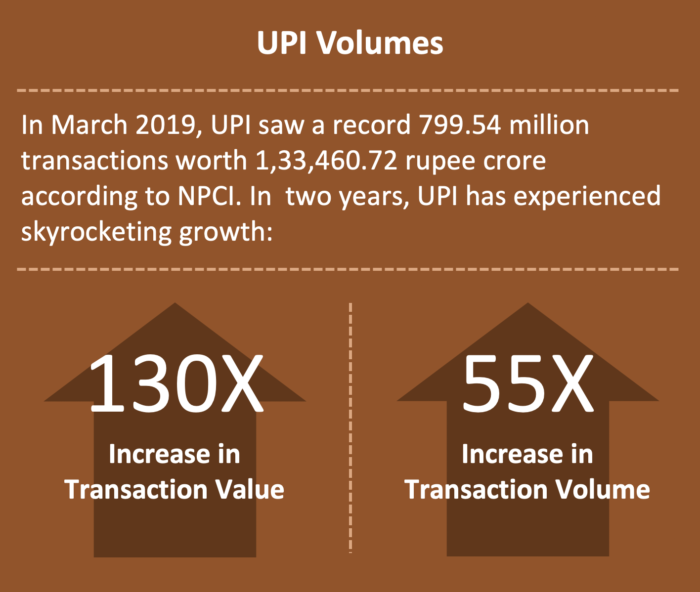

In a short amount of time, UPI grew in popularity and transaction volume, encouraged by:

Free or low cost transactions: Many non-banks offer payments for free. Bank charges are low and merchant payments, at 0.10 + 0.04%, are lower than credit and debit cards

Interoperability: At a system design-level, a user of any UPI application can send money to a user of another application, using his or her alias. Since UPI apps are not locked into bank provider apps, users are able to access transaction accounts offered by both banks and non-banks.

Enabling non-account holding PSPs to participate in UPI through sponsorship: Perhaps most notable, is UPI’s approach to PSPs. UPI defines a Payments Service Provider (PSP) as a payments initiator that allows both banks and non-account holding PSPs (such as Google or WhatsApp) to act in this role. PSPs offer consumers and merchants the ability to securely pay and be paid from/to their bank accounts. Non-account holding PSPs need to be sponsored by a UPI member bank. This capability has driven transaction scale, often facilitated by the non-bank parties. Moreover, it has promoted new entrants to participate, with low barriers to entry, recognizing many of these players are not ‘touching the money’ and can be regulated differently than organizations who are involved in the transaction funds flow.

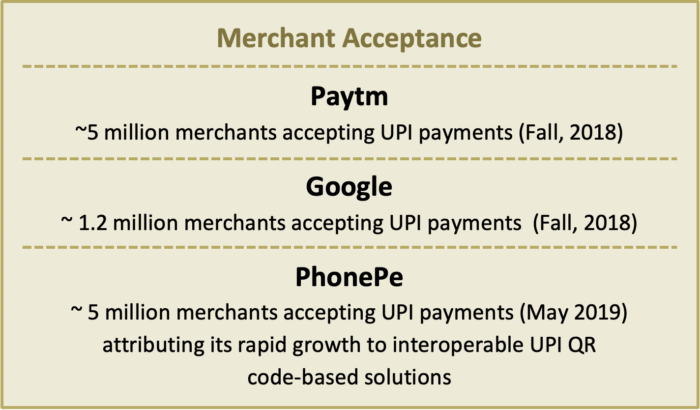

The suite of open APIs: UPI provides a suite of open APIs that further supports non-account holding PSPs’ participation and drives transaction volume. The openness of the system allows third-party payment providers to build payment applications on top of UPI, which fosters a dynamic digital ecosystem. Tech-forward, third-party payment providers, led by Paytm, PhonePe, and Google Pay, create a convenient and straight forward sign-up processes and simplify the process of sending digital transactions. The ease with which providers can join the system and create payment applications, paired with growing smartphone and internet penetration rates, will further encourage adoption of UPI.

Scaling Merchant Adoption

UPI acts as an important bridge behind merchant adoption of digital payments. The largest third-party payment providers invest heavily in merchant acquisition and achieving impressive early success. Furthermore, the roll-out of UPI 2.0 introduces features directed at merchants, such as authenticating merchants while scanning QR codes and requests to pay from merchants, should further encourage use.

Beyond UPI, India Shows an Ongoing Orientation towards Innovation

India payments leaders and regulators continue to display an orientation towards innovation. A few examples worth noting:

The National Payments Corporation of India (NPCI), which operates the suite of digital payments services and processes around half of all digital payment requests in India, recently released an Expression of Interest (IOE) calling for entities to bid to develop a blockchain solution for the payments space.

The Reserve Bank of India (RBI) announced it will develop a fintech regulatory sandbox to support quick, iterative learning on the potential success of new products and services, just one of the many regulatory initiatives from RBI to support digital payments.

“India continues to serve as a model for other countries looking to develop Public Goods/utility solutions that drive scale and meet the needs of low-income and rural consumers.”

Next Topic in this Section: Tanzania