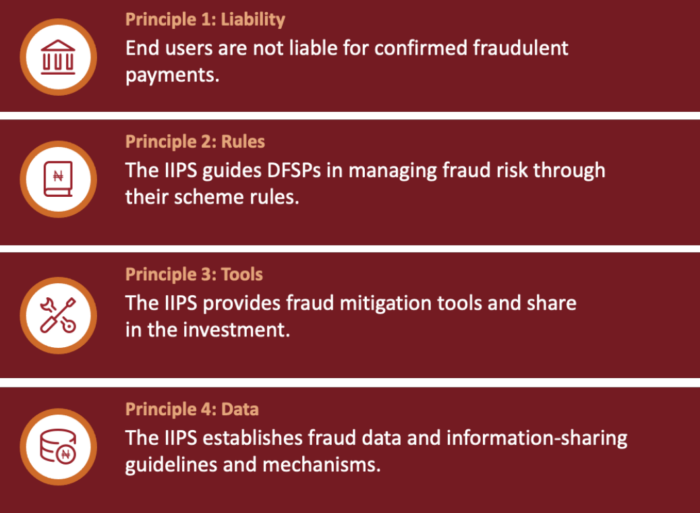

Fraud Mitigation Principles

The fraud mitigation principles are intended to provide inclusive IPSs (IIPSs) a starting point toward effective fraud mitigation. Best practices highlighted in this report for each principle demonstrate how the objectives of the principles may be pursued and actioned.

IIPSs are well placed to lead the ecosystem toward minimizing the detrimental impactof fraud on end users. Most directly, IIPSs can achieve this by providing standards and tools to their digital financial service providers (DFSPs) that are designed to help them manage fraud risk while reducing the cost to individual participants.

DFSPs have a direct relationship with end users to whom they provide transaction accounts. This gives impetus for DFSPs to implement fraud risk controls that prevent loss of end user trust and use of services. Clarity that end users are not responsible for financial losses in cases of confirmed fraudulent transactions provides further incentive for DFSPs to manage the risk closely. The ecosystem will be made safer and more inclusive with IIPSs defining what strong risk management looks like, providing tools to DFSPs, and establishing data guidance.

Next Topic in this Section: IPS are Proliferating